The RBA’s November decision to hold the cash rate at 3.60% has set the tone for the market. Recent data show inflation at 3.2% (headline CPI) and 3.0% (trimmed mean) over the year to September. In other words, inflation is on the high side of the RBA’s target, so analysts expect rates to stay on hold through 2026. For property buyers, this means borrowing costs remain relatively low and certainty is high. In our experience, this steady-rate backdrop is already stoking buyer confidence: roughly 38% of Australians now say it’s a good time to buy, up sharply from last year.

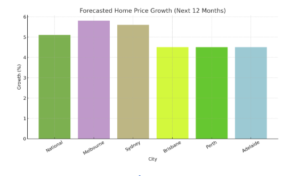

With finance costs stable, experts are forecasting further price growth next year. Finder’s data, for example, suggests national home prices will climb about 5.1% over the next 12 months. Melbourne (≈+5.8%) and Sydney (+5.6%) are expected to lead gains, but Brisbane, Perth and Adelaide are also projected to rise (~4–5%). These forecasts echo industry reports. Ray White notes that smaller capitals and regional markets are likely to outperform into 2026 – driven by strong population inflows and tighter supply. In short, buyers who wait risk facing higher prices. Acting early – and ahead of the predicted 2026 rise – can lock in value today.

Competition is heating up

One consequence of stable rates is strong competition. Low vacancy rates and firm rental yields are drawing investors back into the market. LJ Hooker reports that investors remain active as yields stay attractive and vacancies are tight. This increased demand is visible at auctions. Across the nation, auction clearance rates are hovering near 70%, even with relatively few new listings. In other words, there aren’t many homes for sale, and when a property does come up, multiple buyers are vying for it. We’re already seeing “fear of missing out” in many markets – homes are selling faster and with more offers, especially in high-growth suburbs.

For buyers, the takeaway is clear: low supply keeps prices firm. Our advice is to be prepared. Secure finance pre-approval, know your borrowing power, and act decisively on well-priced opportunities. Markets typically stay busy through the summer, so use this momentum – rather than waiting for next year – to get ahead of the competition. Listing activity usually spikes in late summer, so consider targeting before the February rush.

Strategy for buyers and the role of an agent

In this busy market, using data to make decisions really helps. Key things to understand include:

- Prepare for competition: Given rising investor activity and tight supply, go in with finance in place and flexible terms. Pre-approval and fewer conditions make offers more attractive.

- Leverage expert advice: Working with a property professional gives you tailored market insights. We analyse local data and trends (like auction clearance rates and consumer sentiment) to guide your timing.

At Huddle For Property, we believe informed buyers do better. We combine market data with first-hand experience to find the right opportunities for you. Whether you’re a first-home buyer or an investor, our team can help you set a plan (for deposits, loan structures and suburb selection) so you move confidently.

Want to proceed with confidence? Huddle For Property can help you explore your options and navigate these changes. You can contact us on 0480 758 738 and also book a free consultation. We’re here to ensure you understand your borrowing power and are ready to act on this summer’s opportunities.